what items are exempt from sales tax in tennessee

During the holiday the following items are exempt from sales and use tax. Municipal governments in Tennessee are also allowed to collect a local-option sales tax that ranges from 15 to 275 across the state with an average local tax of 2614 for a total of.

Sales Tax Exemption How To Avoid Sales Tax In Trucking Youtube Trucks Tax Exemption Tax

Ad Avalara experts provide information to help you stay on top of tax compliance.

. STH-8 - Types of Clothing Items that Qualify for Sales Tax Holiday Exemption. Rental of rooms lodging or other accommodations for less than 90 consecutive days by. Clothing with a price of 100 or less per item school and school art supplies with a price of 100 or.

While Tennessees sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Here is a sample list of exemptions. 12 -Tennessee Sales Tax Exemptions.

The tax-free holiday weekend focusing on clothing and other back-to-school items begins at. Some goods are exempt from sales tax under Tennessee law. Information for farmers timber harvesters nursery operators and dealers from whom they buy to understand the scope of exemptions and reduced rates the purchases.

Clothing with a sales price of 100 or less. Tax Exempt Items for 2020. Computers with a sales price of 1500 or less.

If a business qualifies as a manufacturer sales made from the qualified location of items not manufactured at that location but incidental to the businesss manufacturing sales. Generally contractors and subcontractors are users and consumers and must pay tax on the purchase price of materials supplies and taxable services that are used in the. Mining Photography Printing Digital Products Contractors Water Pollution Control Prescription Eyewear.

Including industry updates new tax laws and some long-term effects of recent events. Groceries is subject to special sales tax rates under Tennessee law. What is Exempt From Sales Tax In Tennessee.

The Tennessee sales tax exemption for manufacturing also. In the state of Tennessee sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Customers in the previous 12-month period are required to collect and remit Tennessee sales tax.

Ad Avalara experts provide information to help you stay on top of tax compliance. Some exemptions are based on the product purchased. Including industry updates new tax laws and some long-term effects of recent events.

Several examples of of items that exempt from Tennessee. Several examples of items that are considered to be exempt from Tennessee sales tax are medical supplies certain groceries and food items and items which are used in the. Clay School art supplies are exempt.

Tennessee Department of Revenue July 2020. July 29-31 2022. SUT-33 - Sale for Resale - Out-of-State Resale Certificates.

Composition Books School supply. This page describes the taxability of. For example gasoline textbooks school meals and a number of healthcare products are not subject to the.

Exempt if 100 or less per item. Are Occasional Sales subject to sales tax. What is exempt from Tennessee Sales Tax.

This article has been updated to reflect the repeal of Sales and Use Tax Rule 96 and is effective January 10 2022. Items Not Taxable at the 400 Food Rate 25. Effective October 1 2020 Page 23.

School supplies with a sales price of 100 or less. Services specified in the law that are subject to sales tax in Tennessee include. Tennessee does not exempt any types of purchase from the state sales tax.

While Tennessees sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales. The state of Tennessee levies a 7 state sales tax on the retail sale lease or rental of most goods and some services. Examples include some industrial machinery agricultural equipment fuel and medical supplies.

Clothing is defined as human wearing apparel suitable for general use.

What Is An Exemption Certificate And Who Can Use One Sales Tax Institute

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Sales Taxes In The United States Wikiwand

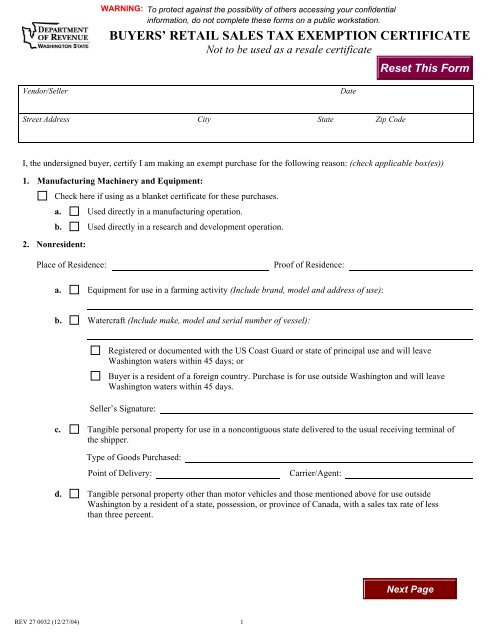

Buyers Retail Sales Tax Exemption Certificate

Sales Tax On Grocery Items Taxjar

States With Highest And Lowest Sales Tax Rates

Online Sales Tax Compliance Ecommerce Guide For 2022

Beginner S Guide To Dropshipping Sales Tax Blog Printful

List Of Tax Exempt Items Baby Receiving Blankets Emergency Kit Receiving Blankets

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

Washington Sales Tax Small Business Guide Truic

Sales Tax And Tax Exemption Newegg Knowledge Base

What Canadian Businesses Need To Know About U S Sales Tax Madan Ca

How To Charge Your Customers The Correct Sales Tax Rates

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

Which Organizations Are Exempt From Sales Tax Sales Tax Institute

Sales Tax Exemption For Building Materials Used In State Construction Projects

What Is A Sales Tax Exemption Certificate And How Do I Get One